What’s the Real Deal? Bridging the Gap Between Reported Pay & Realized Pay

For a long time and even more recently in a pandemic/worldwide health crisis, the compensation of executives, specifically in cyclical and commodity-based businesses, has always been scrutinized. Our firm sees articles like Forbes’ “CEO Compensation is Out of Control” and hears comments from top professionals like Warren Buffet saying, “I do not like what is going on with executive compensation.” To which our firm has been asked on several occasions to opine on the respective investors’ points of view. Compensation is the easiest stone to throw at a respective organization, possibly due to the level of simplified executive compensation disclosures. This simplicity intrinsically provides a false sense of ease of understanding. However, compensation has never been “easy” to understand, just like the benefit options that a company can offer. There are many who don’t even understand the difference between targeted and realized compensation. Further, the truly uninformed tend to take numbers at face value (summary compensation table reported value) rather than comprehending the true value (realized pay value).

Pay for Performance and Shareholder Alignment

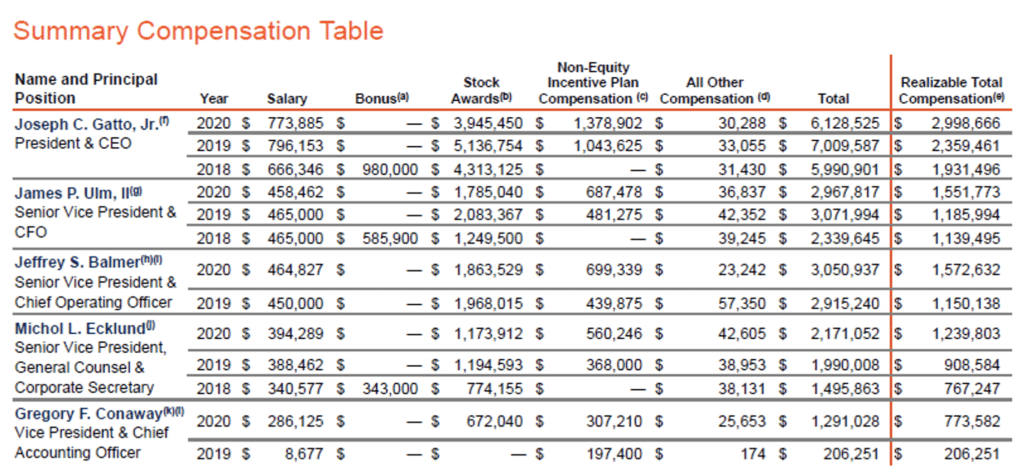

Over the past decade, proxy reform has been a hot topic amongst politicians, institutional investors, and companies alike. Specifically, in the spirit of full transparency of compensation programs, these groups have called for a way to more accurately portray the symmetry between pay, performance, and shareholder alignment. Unfortunately, there currently is not a requirement to provide this linkage within the summary compensation table. However, certain organizations within cyclical markets have begun to layer in these types of disclosures. One company that seems to have taken an educational approach to this is Callon Petroleum Company. In their most recently filed proxy, they show the realizable total compensation as shown below:

The Difference Between Reported Pay and Realizable Pay and the Link to Shareholder Alignment

Callon included the realizable total compensation of their executive management team to illustrate the difference between reported total ($19,129,013) and realizable total ($7,289,623). Pundits will still take their stance that compensation should be directly linked to share price, yet do not take into consideration the various aspects of compensation plans and the utility of each type of payout method i.e., bonus/non-equity incentive is intended to compensate for the achievement of annual hurdles while stock/equity awards are intended to compensate for long-term company performance and viability.

In the case of Callon above, annual objectives were achieved (and disclosed thoroughly) and paid to the executive team while the stock price was severely impacted and thus the stock award value to the executives was also severely impacted, therefore aligning to shareholder interests over a longer period of time. Callon and many others have taken additional steps forward by utilizing similar disclosures within their respective CD&A’s to further help educate current and/or potential investors. Further, in an environment of high scrutiny over growing compensation, perceived or actual, lessening the ability to have a catchy headline that obfuscates the realization that there is shareholder alignment is paramount. This will, at a minimum, illustrate the oftentimes large difference between the reported paper value that companies are judged on versus the actual realized take-home compensation. This is a great approach to helping bridge the gap between what is really transpiring with compensation instead of the uneducated approach that seems to be growing within the general industry.

A Step in the Right Direction

The NFPCC (NFP Compensation Consulting) team believes these types of approaches are a much-needed step in the right direction to educate the public, board members, and investors on how compensation should be looked at and ultimately judged. Lastly, we would be remiss to not provide recognition of the many quality boards of directors we have the honor of partnering with who are asked to make real-time decisions without the ability to have a clear sight projecting the future while understanding past performance does not dictate future performance. Lastly and most importantly, Boards have worked diligently with their respective Management teams to consistently do the right thing by shareholders in the overwhelming majority of organizations and should not be judged by the actions of the 1%, yet based on the specific facts and circumstances surrounding their actions.