Rising Inflation and Executive Salary Increases

Salary budget planning for 2022 has been a hot discussion as companies moved to finalize budgets for this year. In general, salary forecast trends for 2022 are currently tracking to be about one percent higher than previous projections earlier in 2021. Recent pulse surveys (conducted by Mercer, SHRM and WorldatWork) have surfaced suggesting companies are now looking to make increases in the range of 3.5% to 4%, and in some cases, well over this range. This is a significant difference from earlier in 2021 when companies expected to provide budget increases closer to 3%.

Projections over the last six months have swayed wildly, primarily due to the sharp rise in inflation (7%) and ongoing retention concerns. Historically high turnover rates in 2021 have made companies reconsider their initial recommendations regarding 2022 salary increases. And they only appear to be getting larger. The question remains, however, “how big of an impact will inflation play on executive compensation going into 2022?” To begin, we will cover historical salary increase trends over the last five years.

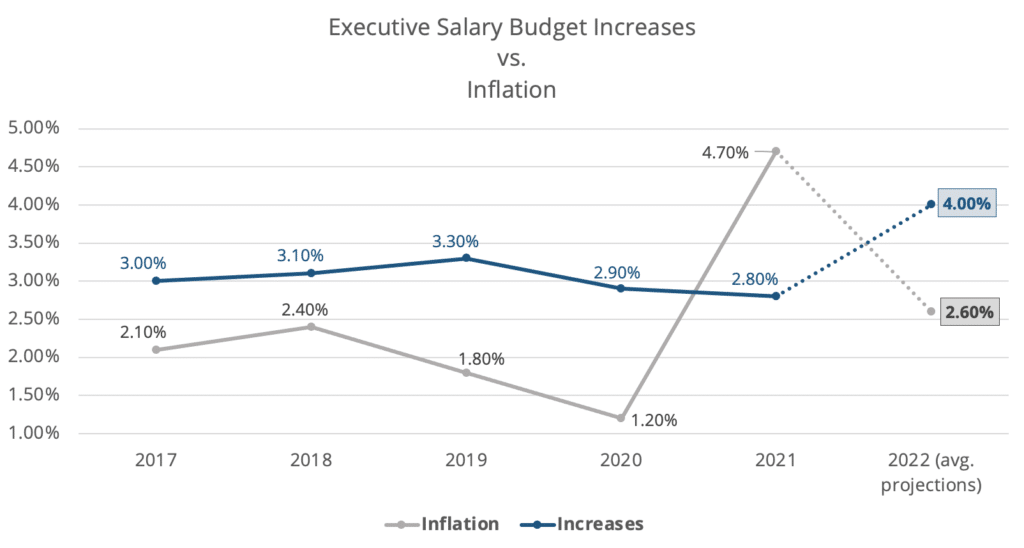

The table below illustrates average executive salary budget increases compared to average annual inflation rates from 2017-2022:

2019 was a record year for executive salary budget increases, 3.3% on average (3.0% at the median). In 2020, many companies across the United States held salaries flat or imposed pay reductions, in response to the onset of the global pandemic. 2020 actuals showed a drop of 0.4%, coming in at 2.9% on average (3% at the median). 2021 actuals showed little signs of a rebound overall, 2.8% on average (3% at the median). Most boards were reluctant to raise executive salaries beyond this range, illustrating a conservative approach to fixed compensation for 2021. Additionally, of those companies that imposed reductions in the prior year, many boards approved reinstatements to pre-pandemic levels. Companies that held salaries flat generally made minimal to no increases and reserved larger market adjustments for key staff at risk of being picked off by competitors.

In conclusion, NFP Compensation Consulting (“NFPCC”) anticipates 2022 actual executive salary budget increases to return above pre-pandemic levels in the range of 3.0% to 5.0% (4% on average) for most companies operating in the United States; however, it is certain that executive wages will still trail inflation, even at the high end of the range. Unless organizations are implementing market adjustments to align executive pay more competitively to the external market, those looking to match inflationary levels will find themselves doing more harm than good over the long run, as inflation is expected to fall below 3% by year-end. NFPCC believes while inflation should indeed be considered in executive salary budgeting, it should not be the end all be all. NFPCC often recommends that a variety of factors be considered when making executive salary adjustments, such as individual performance, value to the organization, time/tenure in the role, among others.

For more information on executive compensation strategy, planning and design, please submit the form below or call us at 281.378.1350.