NFPCC Original Article: CEO Pay Ratio Caps Will Not Work

Just last month, NFPCC’s “CEO Pay Ratio – Winter is Coming” article summed up the latest on the controversial pay ratio rule. This month, we dive into a related subject by taking a peek back in time to the mid-1970s. This past week, a 1977 Wall Street Journal article was re-circulated regarding pay ratios and pay caps. Consequently, we thought it was timely to re-address this hot topic.

Just last month, NFPCC’s “CEO Pay Ratio – Winter is Coming” article summed up the latest on the controversial pay ratio rule. This month, we dive into a related subject by taking a peek back in time to the mid-1970s. This past week, a 1977 Wall Street Journal article was re-circulated regarding pay ratios and pay caps. Consequently, we thought it was timely to re-address this hot topic.

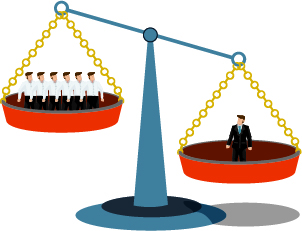

5 – 1 Cap on Pay?

Caps on executive compensation have been a hot topic over the past several years. However, opposition to executive pay can be found as early as the Golden Age of Athens. This is where Plato first suggested that the highest paid member in society should not exceed a ratio of 5 to 1.

Likewise, Peter F. Drucker’s 1977 Wall Streel Journal article “Is Executive Pay Excessive?” states that, “the exact ratio is less important than there should be such a ratio.” The article also states that, “the most necessary innovation [to curb executive pay] would be a published corporate policy that fixes the maximum compensation of all corporate executives, after all taxes but including all fringes, as a multiple of the after-tax and pre-fridge income of the lowest paid regular full-time employee.” Drucker goes on to advocate the relationship between CEO Pay and the average worker should be no greater than 25 to 1. Given our utmost respect to the former Management Consultant (and Plato), one of the most forward thinking gurus whose ideas and writings have helped develop the framework for modern business management, Drucker’s proposal seems to fly in the face of free market economics and recent case studies indicate it will be very difficult to implement. The early 90’s pay cap experiment by Ben & Jerry’s shows us why.

Ben & Jerry’s Petri Dish

In a previous NFPCC article, authored by Chris Crawford, we covered Ben & Jerry’s attempt to limit CEO compensation during the 1990s. The then small ice cream company, with founders at the helm, and now large conglomerate, once had a 5 to 1 rule (like Plato’s) where the CEO total compensation could not be any higher than five times that of the lowest paid employee (or in this case approximately $80,000). When Ben Cohen was set to retire, and search for a new CEO began, the ratio was increased to 7 to 1. Realizing the ineffectiveness of the ratio’s ability to attract, retain and motivate a valid candidate, the company decided on a 17 to 1 ratio in 2000. By the way, this amount did not take stock option grants into account. Shortly after the 17 to 1 total cash modification, the pay cap was abandoned.

CEO Pay Caps Do Not Work

We applaud the amazing story of Ben & Jerry’s, with their delicious products, and corporate social conscience. Additionally, we are strong supporters that both Ben Cohen and Jerry Greenfield have created an amazing company that have richly rewarded its shareholders, most notably the two founders – each are worth about $150 million. However, their trial run at a pay ratio cap has proven what we believe at NFPCC: A free market is the best way to determine reasonable compensation for the country’s best and brightest. Anything short of that and you will get what you pay for.

Ultimately, a trusted independent compensation consultant becomes key in helping companies set CEO pay. The goal is not to set pay levels that seem excessive, but rather customize a compensation structure that is fair and reasonable, based on market research and data, and that is tied to performance to effectively motivate and retain skilled leaders.

For other articles and commentary NFPCC has provided on CEO pay ratios, please follow the following links below: