Does a Higher Governance Score Improve Shareholder Value?

The influence and scope of public company governance advisory firms like Institutional Shareholder Services (ISS) and Glass Lewis & Co (Glass Lewis) continue to widen. These firms continually shift policies and guidelines which in return keeps company management and board members on their toes, and generates significant debates. Many directors take the position that if ISS or Glass Lewis recommend it, they should do it. This position is often generated and encouraged by board members who would like a “good score” or “for vote” by the governance advisory firms. Let’s not forget many of these board members are the top of their class.

As a result of this increasing debate in the boardroom, we at NFP Compensation Consulting (NFPCC) have decided to pose a question and provide an analytical answer to help guide the debate: Does a higher governance score improve shareholder value?

ISS’ Governance QuickScore Background

NFPCC notes that a growing number of companies are turning to ISS’ proprietary Governance QuickScore rating platform for a better understanding of potential concerns related to governance. It is designed to indicate the level of recourse a shareholder has in resolving an issue with the respective company. Per ISS’ website, “as governance factors play a heightened role in investment decision-making, ISS Governance QuickScore provides investors with comprehensive data and quality scores to identify governance risk and support their analysis. Scores provide an indication of management quality, deliver a snapshot view of risk, and are supported by factor-level data that is critical to the research process.” ISS notes that “QuickScore allows investors to understand the issues potentially affecting company performance and enhance their analyses of portfolio companies…” We will dig into the company performance angle a little later to see if there are noteworthy correlations.

Governance QuickScore uses a numeric, decile-based score that indicates a company’s governance risk relative to their index or region, with a 1 indicating the lowest governance risk and a 10 indicating the highest. Companies are assigned an overall QuickScore and are also analyzed on four governance pillars: Board Structure, Audit & Risk Oversight, Shareholder Rights, and Compensation. While the overall platform is proprietary and changes on an annual basis, we note that nearly 200 factors are analyzed, including director accountability, board diversity and board refreshment. Each of the 200 factors is assigned a weight which varies based on ISS’ understanding of governance practices and ISS voting policy. The table below highlights some of the topics covered in the ~200 factors.

Governance Pillars

| BOARD STRUCTURE | COMPENSATION | SHAREHOLDER RIGHTS | AUDIT |

|---|---|---|---|

| Board Compensation | Pay-for-Performance | One Share One Vote | External Auditor |

| Composition of Committees | Non-Performance Based Pay | Takeover Defenses | Audit & Accounting Controversies |

| Board Practices | Use of Equity | Voting Issues | Other Audit Issues |

| Board Policies | Equity Risk Mitigation | Voting Formalities | |

| Non-Executive Pay | Other Shareholder Rights Issues | ||

| Communications & Disclosure | |||

| Termination | |||

| Controversies |

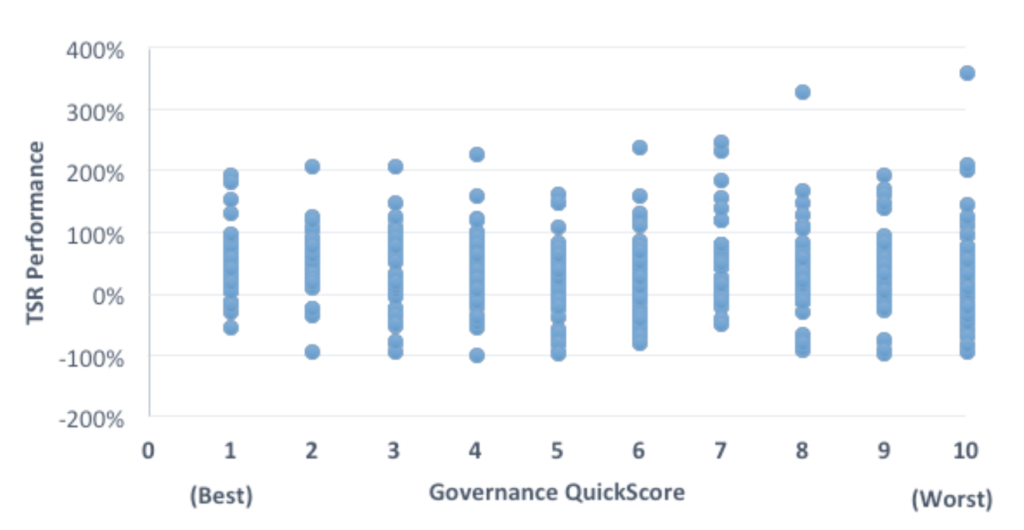

3 YR TSR

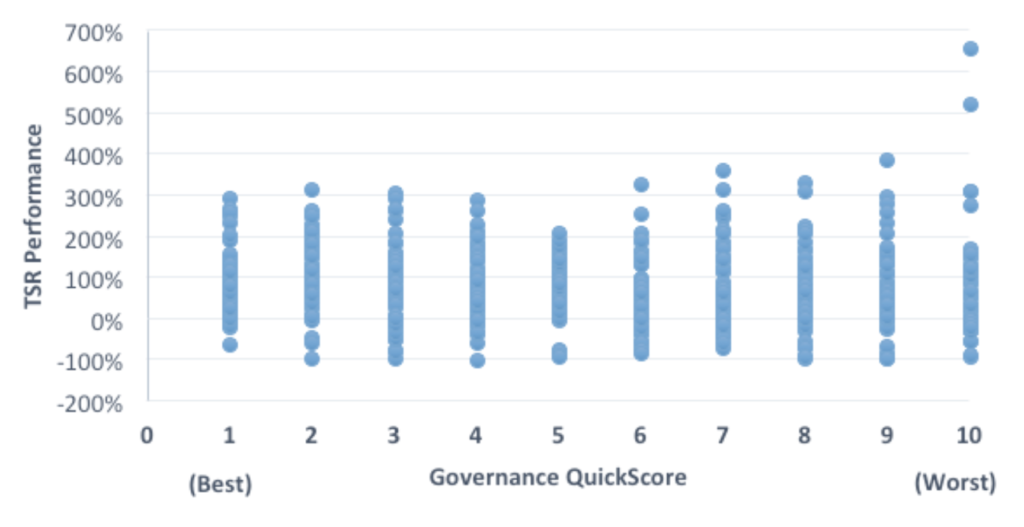

5 YR TSR

Key Takeaways

We note the following key takeaways based on Governance QuickScore data:

- There is no correlation between a company’s Governance QuickScore and TSR performance, the metric often identified as a key performance measure in executive long-term incentive compensation plans.

- Improving a company’s Governance QuickScore may ease institutional voting on items like Say on Pay, but there is no evidence it will improve shareholder value.

So what does this mean for directors? We believe that while firms like ISS and Glass Lewis are effective platforms for identifying and laying out certain key issues impacting today’s governance world, boards should take these platforms into consideration when making governance decisions. While certain factors, and their corresponding “best practices” might make sense for implementation, boards should analyze their governance programs in aggregate and make informed determinations on what is in the best interest of the company and its shareholders, not necessarily in the best interests of advisory groups or special interest groups.

In summary, NFPCC concludes that good governance is key for every company. Where the debate begins is how we define “good governance. The governance agendas and platforms proposed by institutions and advisory firms should be thoroughly reviewed by board members, but with question marks at the end of the sentence rather than periods or exclamation points.

NFPCC is here to help if you are uncertain about the impact of your current governance practices, or would like more information on the key governance factors proxy advisors are zeroing in on. Feel free to contact any of the members of our team who will be more than willing to assist.