Oh, Pay vs. Performance! Oh, My Goodness!

Pay vs. Performance?

“Okay, it’s happening, everyone stay calm.” – Michael Scott

Last month, after nearly a decade, the Securities and Exchange Commission (SEC) adopted final Pay vs. Performance rules (“Final Rules”). These Final Rules, while more complex than what was originally proposed in 2015, will require companies to report on the relationship between company performance and executive compensation in proxy statements beginning in Q1 of 2023. In this month’s article, NFPCC highlights key requirements of the Final Rules along with our perspective and recommended action steps ahead of the 2023 proxy season.

What’s the Procedure?

“Oh, fire?! Oh, my goodness! What’s the procedure? – Dwight Schrute

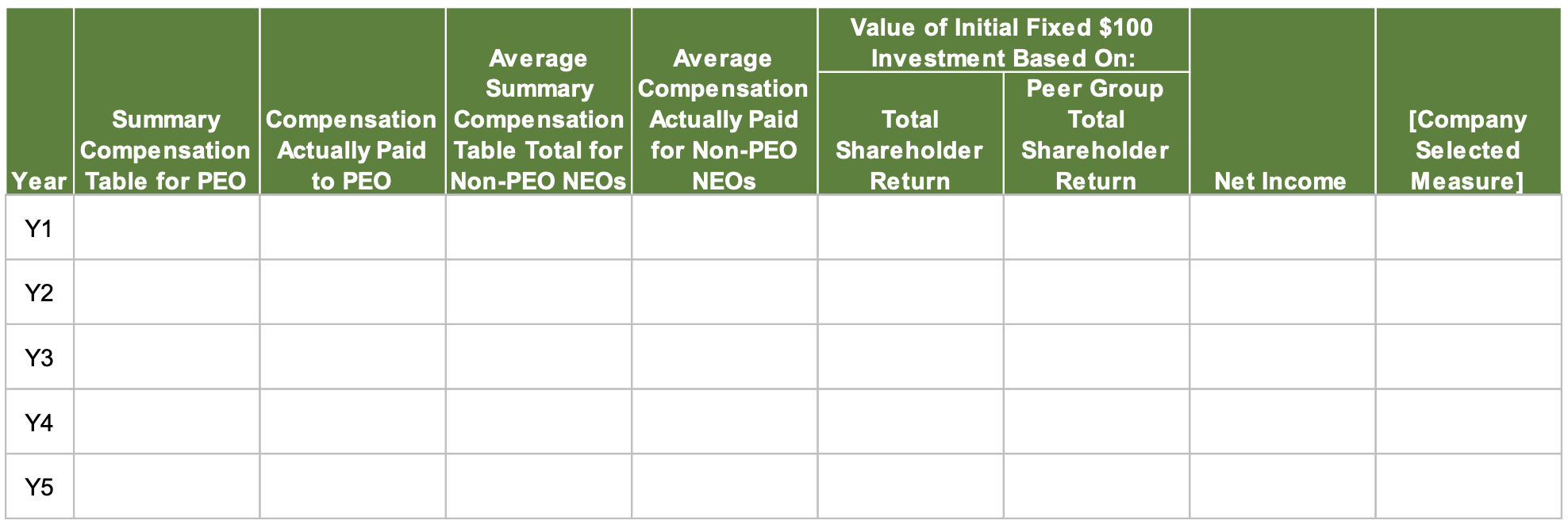

Final Rules go into effect for companies with fiscal year ends on or after December 16, 2022. A tabular disclosure (below) containing specific items is required.

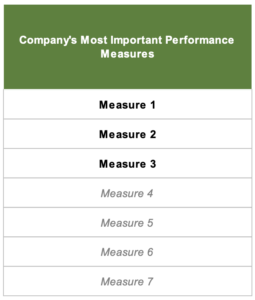

In addition to a graphical illustration, companies will need to provide a clear narrative describing the relationships between compensation actually paid (“CAP” or “realizable pay”) and three performance measures (TSR, Net Income and Company Selected Measure), as well as the relationship between the company’s TSR and the TSR of its selected peer group. Lastly, companies will also be required to provide a tabular disclosure of three (and up to seven) measures that it determines are its most important performance measures for linking CAP and company performance.

Where is this Headed?

“Okay, that’s the wrong way. We’ve already tried that.” – Dwight Schrute

There is no question that the SEC’s decision has created a wide spectrum of opinions regarding the Final Rules. However, conclusions can be drawn that many will not only find the new rules costly and complicated but likely not very useful or even applicable in some cases. In NFPCC’s experience, most boards and compensation committees do not utilize compensation actually paid to evaluate executive pay. Further, some companies do not even consider TSR or Net Income as key metrics when making executive compensation decisions. So why over-standardize something that may not help tell every company’s pay versus performance story? Whatever the reason, rules are rules. SEC Chair Gary Gensler’s Statement on Final Rule Regarding Pay Versus Performance, said that “this rule will help investors receive the consistent, comparable, and decision-useful information they need to evaluate executive compensation policies. That serves investors and our markets”.

While the SEC admits that “there continues to be no consensus around the best approach to analyzing the alignment of pay and performance”, there does seem to be some consensus around the extensive time and cost as well as complexity that these Final Rules will impose; specifically, around the revaluation of equity. In addition to complex calculations, it may be difficult for some companies to draft a clear narrative explaining the correlation between compensation actually paid relative to the prescribed measures (TSR and Net Income), because there may not be a direct link, and thus no apparent correlation.

What may be more concerning than the new burdens, is the resulting pressures from investors and shareholder advisory firms that are sure to mount over the coming years. Instead of using these Final Rules as a way to display information, it is possible that they will be weaponized and create more confusion, not clarity. While most companies with buttoned-up compensation philosophies already have a clear understanding of linking executive pay to company performance, external pressures may attempt to push boards and compensation committees to place an emphasis on the newly prescribed metrics (TSR and Net Income), specifically, within incentive programs. In NFPCC’s view, this could very well be the start of an incentive plan design overhaul.

What Do We Do?

“Use the surge of fear and adrenaline to sharpen your decision-making.” – Dwight Schrute

There’s no escape, but there are a few steps public filers should take right away to prepare for the upcoming proxy season. NFPCC has outlined a non-exhaustive list (below) for consideration:

- Begin compiling data, now. Because the first year of reporting only requires data points from the three prior years, companies can begin compiling total shareholder return and compensation actually paid for years 2021 and 2020, then push to incorporate 2022 data points following year-end. To stay ahead, run calculations for 2019 that will need to be included in the 2024 proxy.

- Hold discussions. Decide what metrics are most important when it comes to compensation decisions. Remember, the Pay vs. Performance Table requires one company selected metric, and a second table containing 3 and up to 7 other metrics is also required. Decide which peer companies should be considered for inclusion in the peer group to use for TSR comparisons. For some already utilizing performance peer groups, specifically those with LTI programs already utilizing TSR, this should be straightforward. For those new to performance peer groups, NFPCC can assist in the peer selection process.

- Prepare the narrative. Once preliminary figures for the Pay vs. Performance Table are available, begin crafting the story on how compensation actually paid (CAP) relates to company performance (TSR, Net Income and Company Selected Metric) and how company TSR relates to the peer group TSR. For many, this may be the biggest challenge, especially if there seems to be little correlation.

As compensation experts and CD&A design specialists, NFPCC has the ability to assist in crafting your company’s pay vs. performance story. Contact us below to get started.

See Also:

Renewed Focus on Executive Pay for Performance »

References:

- “Stress Relief.” The Office, created by Ricky Gervais and Stephen Merchant, developed by Greg Daniels, directed by Jeffrey Blitz, written by Paul Lieberstein, season 5, episode 14, NBCUniversal Television Distribution, 2009.

- SEC Chair Gary Gensler, Statement on Final Rule Regarding Pay Versus Performance, https://www.sec.gov/news/statement/gensler-statement-pay-vs-performance-082522

- SEC Pay Versus Performance, https://www.sec.gov/rules/final/2022/34-95607.pdf